Despite this side movement of the price of land, however, investors continued to accumulate Solan and waited for a possible breakthrough of the bull. While, while Altcoin has completed a relatively stable month of May, they could affect certain key factors in June in June.

Solana needs institutional support

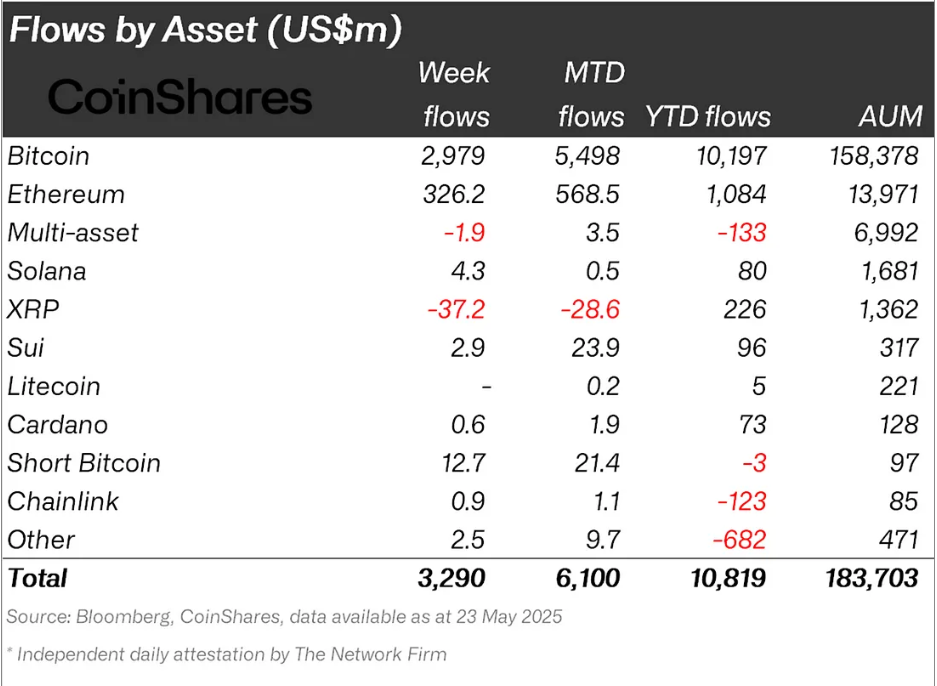

In May, the institutional interest in Solan proved to be significantly weak. The land market was actually overshadowed by the rise of Sui, a newer blockchain, who offered more opportunities for developers and gained considerable traction. While SU recorded $ 23.9 million records, Solana attracted only a modest amount of $ 0.5 million, making it one of the blockchains less popular with institutional investors.

This item was even lower than Cardano ($ 1.9 million) and Chainlink ($ 1.1 million) for the same period, showing that institutional interest for solan has decreased. As a result, the institution in the coming months are likely to focus on other blockchain projects. The lack of participation of these investors could lead to a loss of large entry for Solan, which would risk affecting its long -term growth.

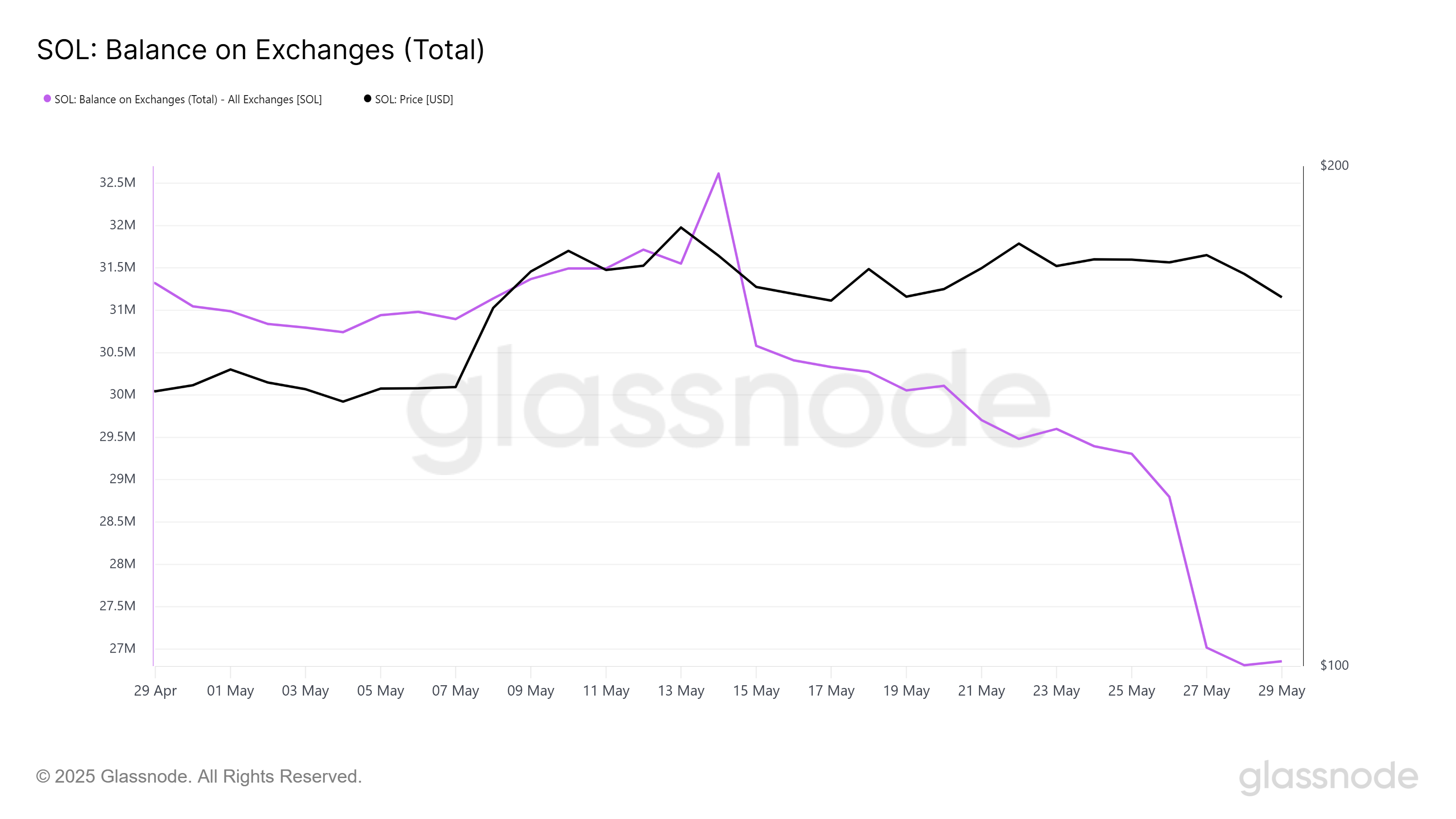

However, although the institutional interest in Solan has decreased, private investors and whales always seem to be confident in its future potential. The balance on cryptocurrency shows a soil reduction of 4.13 million worth more than $ 677 million last month. This trend suggests that small special investors such as large whales believe that Solana is undervalued at current levels.

Continuous soil accumulation also prevents altcoin to experience significant decreases, even in the middle of wider market fluctuations. This investor’s belief suggests that the Solana course may not be in the main decreases in June, although there is no longer a reduction in feeling on the market market.

Towards the profits in June for the Solana course?

At the time of writing, the Solana course was $ 164, which since the beginning of May meant an increase of 11.5 %, but a decrease of 12 % compared to the peak of the month. Due to mixed signals from institutional flows and accumulation, individuals should remain a limited extent in June. It will probably continue to oscillate between $ 161 support and $ 178 resistance, with key levels that would require a strong pulse from the entire bull market market.

If Solana manages to exceed $ 178 and keep over this point, the price could increase around $ 188. This movement would be supported by the Golden Cross scheme, where EMA intersects EMA after 200 days. The cross signals bull momentum, and if it is confirmed, the solana could approach the multi -year peaks.

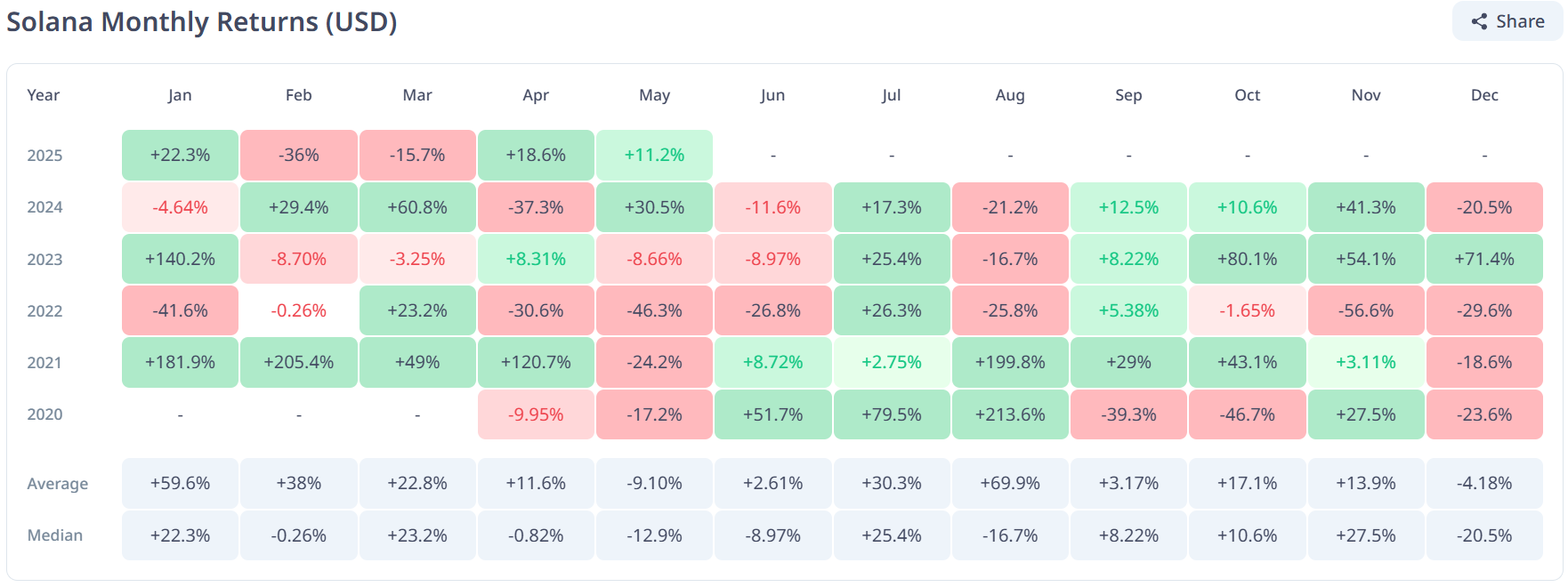

However, investors should note that in June it proved to be a basic month for Solan. Indeed, the Cryptorank data shows that in the last five years the monthly king varied from negative to positive. However, the Central King established himself at -8.97 %.

Therefore, if the same situation repeats and the signals of the general market become negative or that investors decide to make profits, the Solana course could experience a decline. Fall below the support of $ 161 would increase concern, which can potentially increase the price to $ 150 or even $ 144. This scenario would cancel ascending work and could indicate future losses for land holders.

Morality of History: After Solana comes Sui.

Notification of irresponsibility

Notice of irresponsibility: In accordance with the Trust project Directives, this article for price analysis is intended only for information purposes and must not be considered financial or investment advice. Beincrypto undertakes to provide accurate and impartial information, but market conditions may change without prior notice. Always carry out your own research before making any financial decision and consult a professional.