15:00

5

min at reading ▪

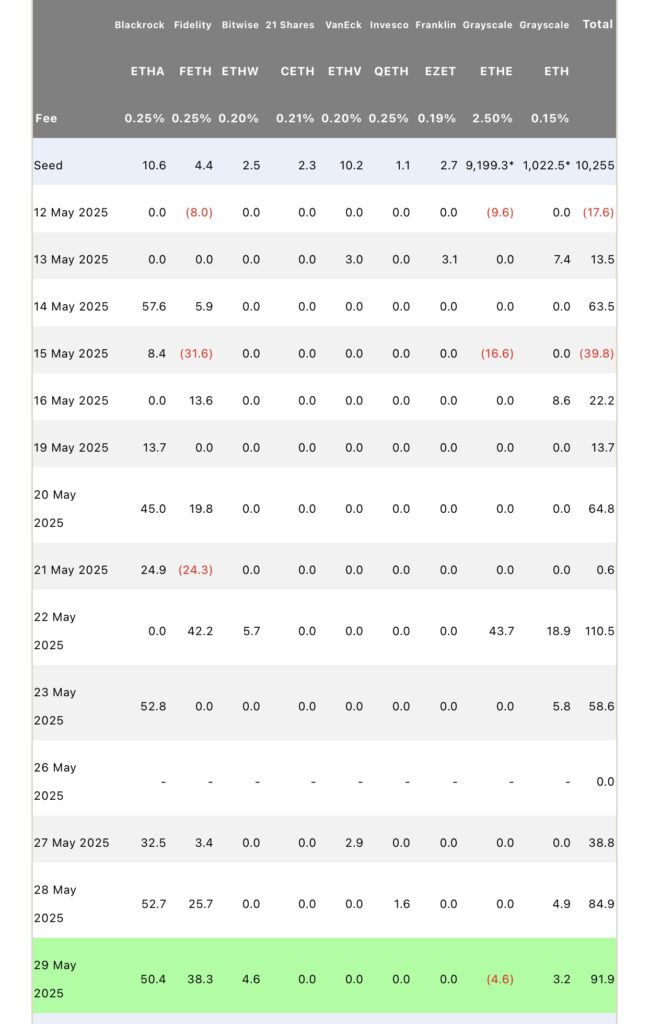

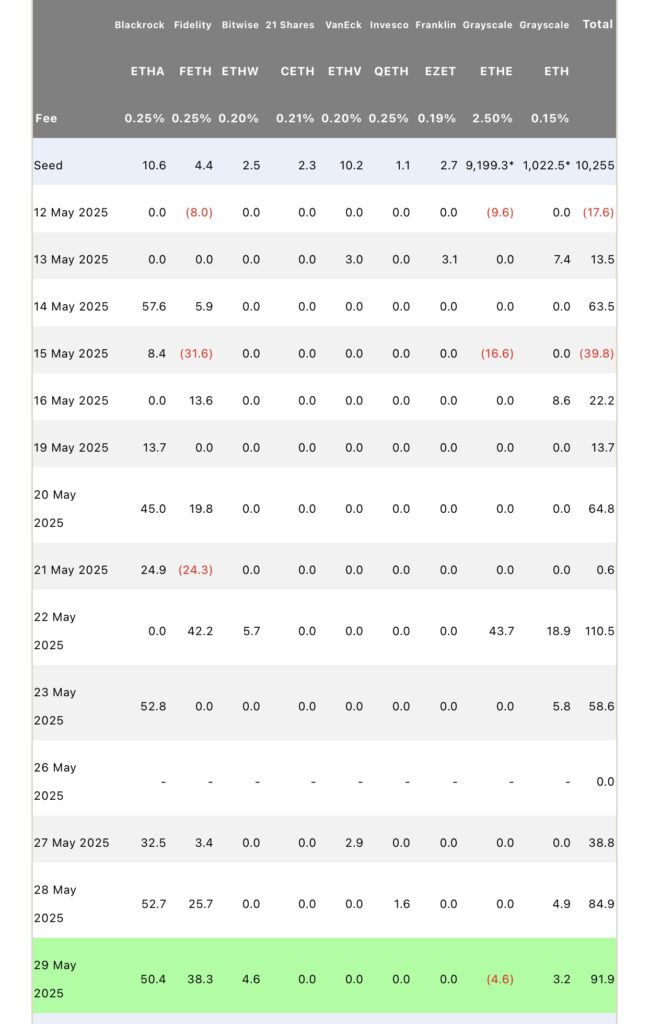

Ethereum is a remarkable return to the crypto scene. With $ 163 million injected into its ETF in a few days, technical and basic signals are aligned. Will the market wonder: Will the threshold value be $ 2,900 exceeded? Explosive dynamics, carried by institutional investors appear to appear.

In short

- Ethereum Ether records $ 163 million, with respect to Blackrock.

- The indicators on the string and techniques show bullying with RSI at 70.47 and a critical threshold of $ 2,720.

- Peter Brandt expects ETH for $ 4,000 and starts a debate on the new Bull Cycle.

Why Ethereum Ethe again attracts large investors

The Krypto market has seen a strong signal: Etfe Ethereum has recently attracted $ 163 million, including $ 71.3 million per week and 92 million per day 29. At this date, Blackrock was distinguished by capturing 50 million, confirming his role as a catalyst for the return of institutional liquidity. This massive capital injection reflects the renewed perception of the ETH potential, despite the persistent regulatory uncertainties.

This renewed appetite could be a trigger for permanent dynamics of Ethereum operations if the momentum is settled. The ETF thus becomes a barometer of macroeconomic confidence in the crypts, for simple speculative madness.

Crypto: These signals on the string that confirm the return in Ethereum

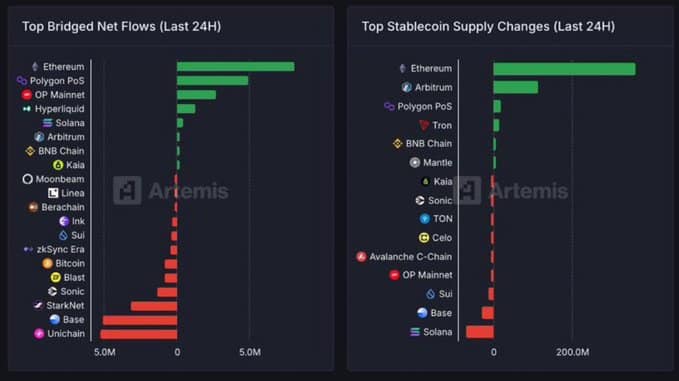

In addition to the flows to the ETFS indicator on-the-session confirm that the Ethereum network is expanding:

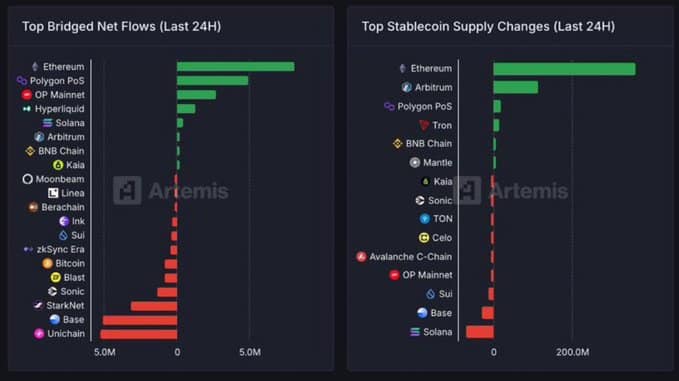

- Increasing the flows of clean flows between the chain: Ethereum exceeds its direct competitors with interaction through bridges;

- Stablecoin growth offers: +4.1 % in the last two weeks;

- Increasing the activity of active portfolios: +12 % in 7 days.

These elements reflect solid structural dynamics, far beyond $ 71 million records in Ethereum in one week. As a result, ETH again attracts developers, crypto and capital users, on a market where bitcoins are also experiencing decisive movements. This combination could justify a higher award in the coming weeks.

Immediate escape? Technical indicators are kidnapped for ETH

The Ethereum Graphic Analysis Displays Signals Aligned with Bull Basics:

- RSI at 70.47: near the Suurahat area signaling high shopping pressure;

- CMF up to 0.15: indicates clean capital inputs on several consecutive sessions.

However, Ethereum meets the main resistance to $ 2,720. If ETH manages to interrupt this threshold, it would confirm sufficiently strong dynamics that would explode $ 2,900 or even $ 3,400. On the contrary, a break below $ 2,650 would strengthen the side consolidation scenario with a possible return to $ 2,450 or $ 2,300, as Ryan Lee, the main analyst of Bitget Research.

The Ethereum continues to be exchanged in a narrow range of $ 2,11 and $ 2,819 (…) of the Hussiers’ technical signals, including the Golden Cross 18th May … indicate that the horizon could disintegrate. If Ethereum exceeds $ 2,700 with a convincing volume, it could target $ 3,000 to $ 3,400. However, the inability to exceed the resistance could trigger a new test of $ 2,500 or $ 2,300.

The market is therefore at the intersection: rupture or shortness of breath up. The next few days will be decisive.

The current enthusiasm around the Ethereum could be intensified if the technical resistors give up. However, volatility remains high and euphoria after ETF could fade quickly. In this context, the courageous prediction of Peter Brandt, due to the Ethereum at $ 4,000. This conversion of historically skeptical analyst raises the key question: is it a simple reflection or the beginning of the new Bull’s cycle for ETH?

Maximize your Cointribne experience with our “Read to Earn” program! For each article you read, get points and approach exclusive rewards. Sign up now and start to accumulate benefits.

The world is evolving and adaptation is the best weapon that survives in this undulating universe. I am interested in everything about blockchain and its derivatives. To share my experience and promote an area that fascinates me, nothing better than writing informative and relaxed articles simultaneously.

Renunciation

The words and opinions expressed in this article are involved only by their author and should not be considered investment counseling. Do your own research before any investment decision.