Context for Chatgpt:

Bitcoin, a digital blockchain -based asset, is particularly known for its safety system, based on the concept of cryptography, making it impossible to hack the holder’s portfolio.

Drake was an alarm concerning a critical error in the Bitcoin evidence mechanism (Pow). According to him, if not repaired, this defect could endanger the entire ecosystem of the cryptocurrency.

Bitcoin, the system is not so sure

Drake’s argument focuses on a sharp drop in the cost of bitcoins that have achieved their lowest level in 13 years, less than 10 BTC a day.

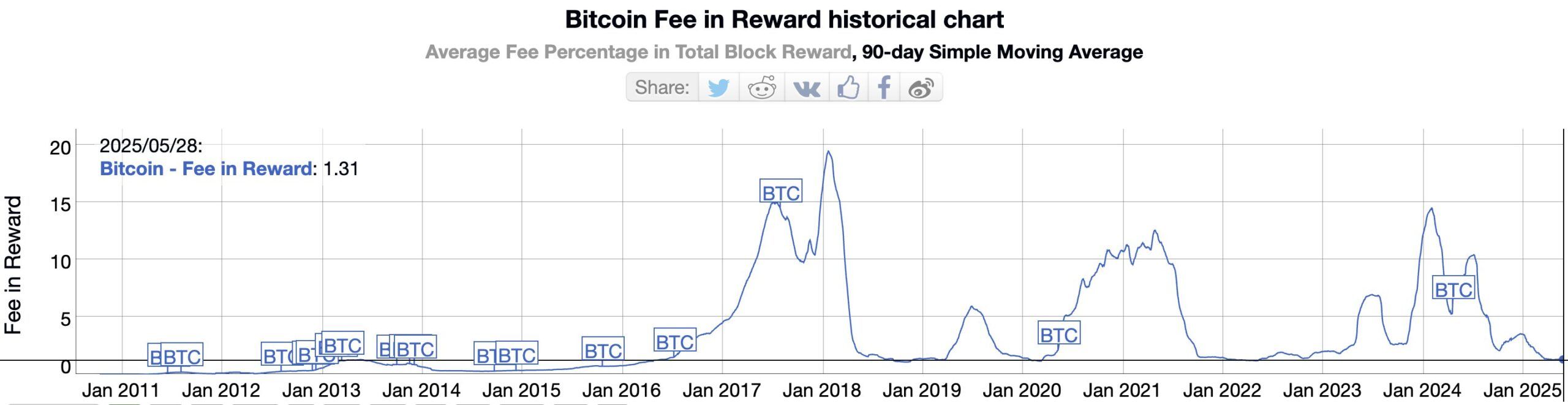

He explained that transaction costs are only about 1 % of minors’ income. The remaining 99 % come from block rewards, new bitcoins generated to encourage minors to secure the network.

However, these block awards have decreased half -reduced during an event known as the bitcoin half. In April 2024, the price of the block dropped to 3.125 BTC. This trend will continue until the total offer of bitcoins has reached a solid ceiling of 21 million parts.

Historically, the Bitcoin community believed that transaction costs would increase as block rewards would be reduced, ensuring that the motivation of minors remains to maintain network safety. Today, however, data suggests the opposite situation today. Over the past ten years, transaction costs have actually decreased even faster than the prices of bitcoin blocks.

For example, in March 2016, transaction costs were 1 % of the price of the block for 25 BTC. In April 2025, even the IS remuneration of a block reduced to 3.125 BTC, the costs still represented only 1 %. This persistent decline in costs is reduced by the budget for the safety of bitcoins, the financing itself, which supports minors. As a result, the network is becoming increasingly more vulnerable to attacks.

“Imagine that costs are the only source of income for minors today:

→ Receipt dropped 100 times

→ Hash infrastructure decreases by 100 times

→ 1 % of current infrastructure (1 large farm) can attack Bitcoin at 51 %

This is the trajectory we are on. 21 million ceiling security. Now it should be clear that Satoshi made a mistake. ” – said Justin Drake.

Initiatives to increase the usefulness of transactions and increase in costs have ended in failure. Initiatives such as Lightning Network, Liquid, Stacks and Ordinals were eventually caused by temporary costs for costs, followed by a decline.

As a result, the safety of bitcoins still strongly depends strongly on block rewards, which is the final source that eventually disappears under the current model.

This means everyone is not in Drake’s opinion. Kushal Babel, a research worker in the Labs categories, claimed that transaction costs should be measured in US dollars, not in BTC to understand their real trend.

“It is wrong to say that the costs are at a historically low level by expressing them in BTC. It depends on safety in terms of dollars; we must take into account the price of BTC/USD. This could give us another perspective.

Did Satoshi made a terrible mistake?

Drake has suggested two possible solutions to prevent the safety crisis in the bitcoin network. But one another is very controversial with the community.

The first would be to introduce PERPETAL BLOCK Awards by removing the ceiling of 21 million BTC. However, this would break the basic principle of bitcoins: its rarity as a digital income. The second option is to leave Pow and go to the consensual evidence mechanism (POS), as Ethereum did in 2022. Pos actually rests on validators that “involve” cryptos instead of using computing power. This mechanism is more energy efficient and can offer a model of more sustainable safety.

However, these two ideas are culturally unacceptable for many bitcoins, as they question the basic principles of rarity and decentralization of assets.

Lukasinho, a strategic analyst of Auditles, claimed that Satoshi had not made a mistake. On the contrary, he thinks that Bitcoin has moved away from the original vision of Satoshi and has become a reserve of value that does not generate sufficient transaction activity to increase costs.

“Satoshi did not make a mistake and 21 million is not wrong. These are small blockers that made a mistake. The Satoshi vision was such that the BTC became a digital currency that is often used and creates transaction costs. Not that it becomes a pebble in the wallet.

However, there is a factor that Satoshi probably did not expect: quantum attacks.

Given the necessary costs and coordination, the attack may seem 51 %, such as Drake attack, unlikely. However, experts have recently multiplied warnings regarding the threat represented by quantum computer science. This technology could actually break bitcoin cryptography, which only increases the urgency of the development of a robust and sustainable security model.

Morality History: No human system is infallible.

Notification of irresponsibility

Notice of non -response: In accordance with the TRUST project, Beincrypto undertakes to provide impartial and transparent information. The aim of this article is to provide accurate and relevant information. However, we invite readers to verify their own facts and consult a professional before it decides on the basis of this content.